EUR/USD Trade Example 1

Intraday Pin Bar Strategy Simulations: EUR/USD Trade Example 1

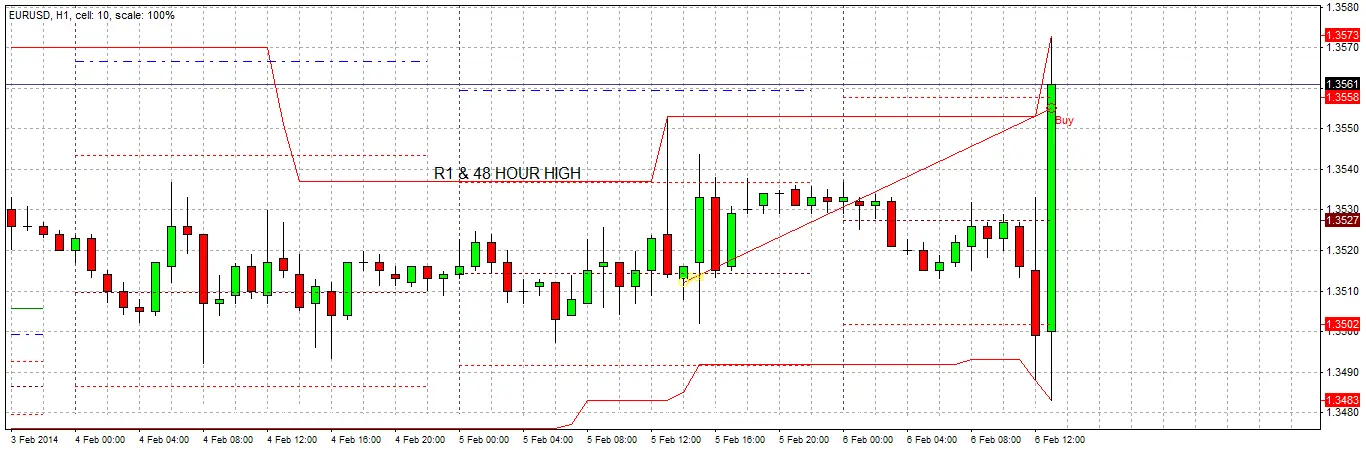

Based on actual trading data from Feb 05, 2014. Using the Intraday Pin Bar Strategy on a major currency pair, we enter a long-term trade on an intraday basis. The Hourly Pin Bar signal, position of support and resistance, and pivot points are considered before entry. The trade is given an unlimited ultimate profit target over at least two exit levels, and is open for one day.

EUR/USD Trade Example 1

Subjects Covered:

- Intraday Trading

- Signal Candles

- Position of Support/Resistance

- Pivot Points

- Multiple Profit Targets

- Trade Management

Enter EUR/USD Short at 1.3512, SL at 1.3555

A strongly bearish large pin bar formed on the hourly chart soon after New York opened. The wick of the bar showed a strong and sharp rejection from the 48 hour high and the daily GMT S1 pivot point. We enter an order to go short just below the low of the hourly candle, with the stop loss just above its high. We will take off half of the position at 1.3468, taking all the risk off the trade, and leave the rest to run.

Trade Progress

The next day, after the trade has been open for almost 24 hours, we can see that it has not been going very well so far, although it is in profit. For several hours after entry the price tried to rise, before eventually falling.

News

Some very important news events that are likely to affect this pair are going to occur soon: the EUR Minimum Bid Rate will be announced at 13:45, and shortly afterwards there will be an ECB Press Conference and key US data releases. Many observers are expecting the ECB will cut rates, which should be good for our trade.

We are not very far from our stop loss, so it is a good idea to protect ourselves by taking enough profit now to remove the risk from the trade.

1st Trade Exit

As our trade is only 13 pips in profit, but has a risk of 43 pips, we have to take off slightly more than 2/3 of the position to remove the risk from the trade.

Final Trade Exit

The sharply increasing volatility in the minutes leading up the high-impact news triggers our stop loss. We are now out of the trade, and we have broken even as we took the risk off the trade a few minutes ago.

Conclusion

It is possible to trade profitably and completely ignore news events. You should not let upcoming news panic you out of a good trade. It is also true that “accidents tend to happen along the line of least resistance”, so good trades tend to be helped and not hindered by news releases.

However, when there is an upcoming news release and your stop loss is within easy reach of typical pre-news volatility – as was the case here – your trade outcome is likely to be little more than a 50/50 gamble. In these cases, moving to protect the trade, as we did here, can be a wise move.