EUR/USD Trade

Multiple Time Frame Momentum Strategy Simulations: EUR/USD Trade

Based on actual trading data from June 03, 2013. Using the MTFM strategy on a major pair, we use naked chart analysis to identify a strong S/R zone, and drop down to lower time frames to pinpoint low-risk entries. The MTFM and Signal Candles, position of the highs and lows, and position of support and resistance are considered before seeking an entry. Different exit strategies are considered as a high-impact news release becomes imminent.

EUR/USD Trade

Subjects Covered:

- MTFM Strategy

- 200 EMA

- Multiple Time Frame Coordination

- Signal Candles

- Position of Support/Resistance

- Highs and Lows

Signal 1

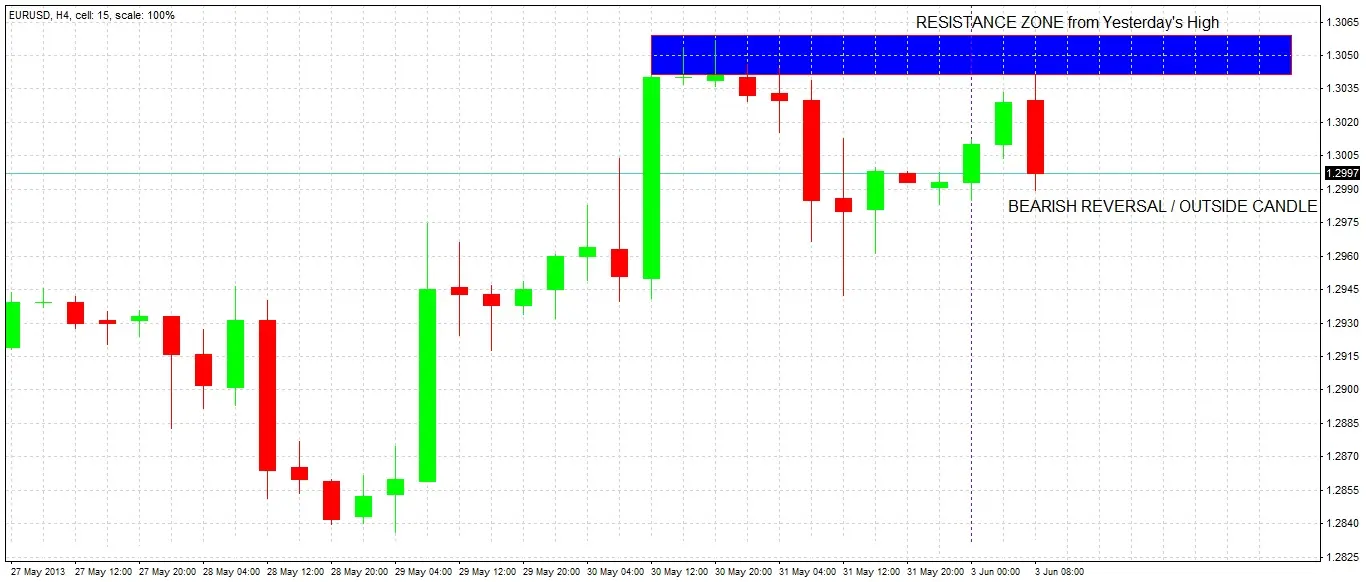

The 4 hour chart prints a bearish reversal candle during the first half of the London session. The candle is large, full-bodied and is also an outside candle. That’s a good short signal, but we need to look at the wider picture now.

Closer Look at SR Zone

Let’s see if the reversal candle is rejecting a resistance zone. Looking at the same 4 hour chart, we can see that the upper wick of the reversal candle was rejected from a resistance zone formed by the upper wicks of candles from yesterday’s high prices. It looks good so far but we still need to look deeper.

Caution?

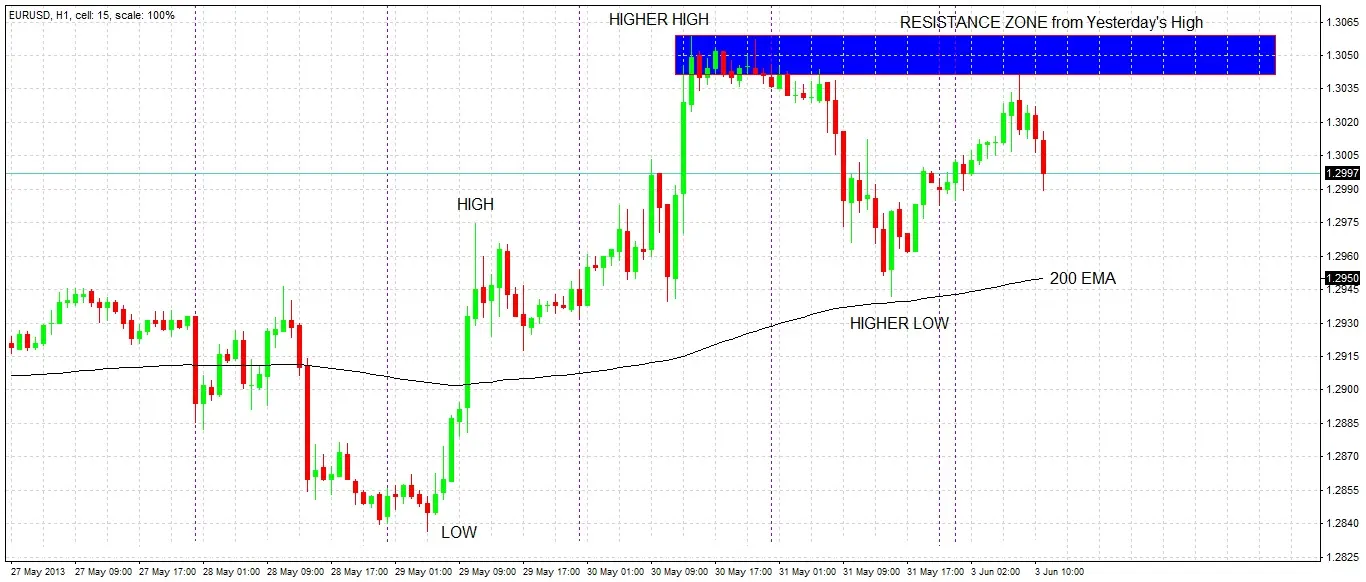

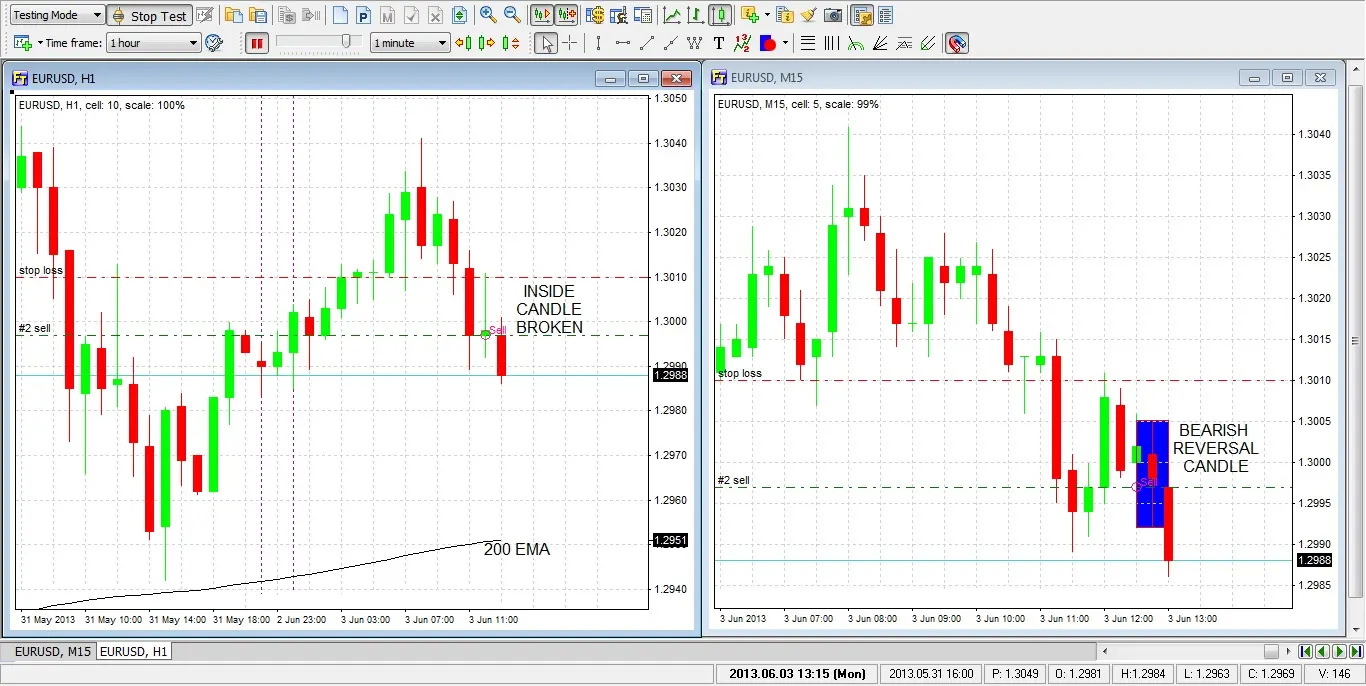

Dropping down to the 1 hour chart for a closer look, we can see that this pair has been in an uptrend for the last 3 or so days. It has been making higher lows and highs, but it might have just made a lower low. Looking at the 200 EMA below, we can see that it is angled up and gave some support to yesterday’s low price. The last 4 candles look bearish and include another reversal candle. We can conclude that this looks like a good set up for a short, but we should be prepared to be fairly conservative with our profit taking, as we might still be within an uptrend.

Trade Decision

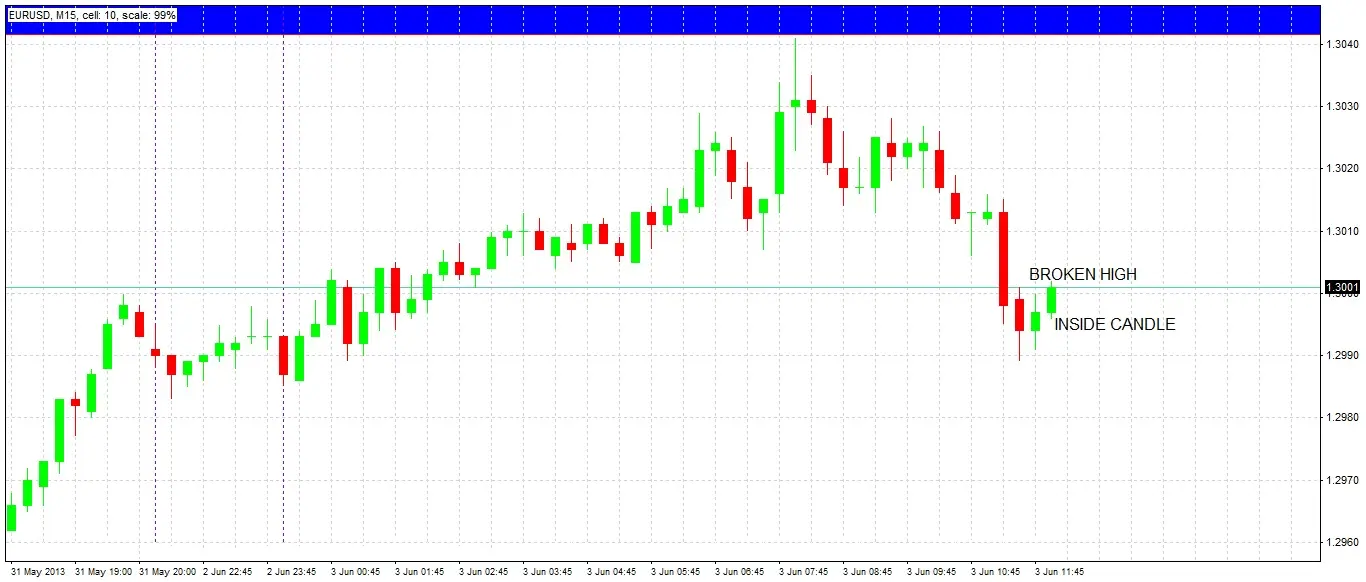

It is time to decide about how to try to enter and exit a short trade. The round number of 1.2950 a little above yesterday’s low of 1.2942 looks like a sensible profit target. As we want to aim for a good reward to risk ratio, we decide to drop down to the 15 minute time frame and look for a signal candle right away. There is an inside candle right now. Notice it is bullish, which is not optimal. However we will enter if the low is broken by 1 pip during the next candle.

No Entry

The high of the signal candle is broken, invalidating the signal. We wait for another signal candle.

Signal 2

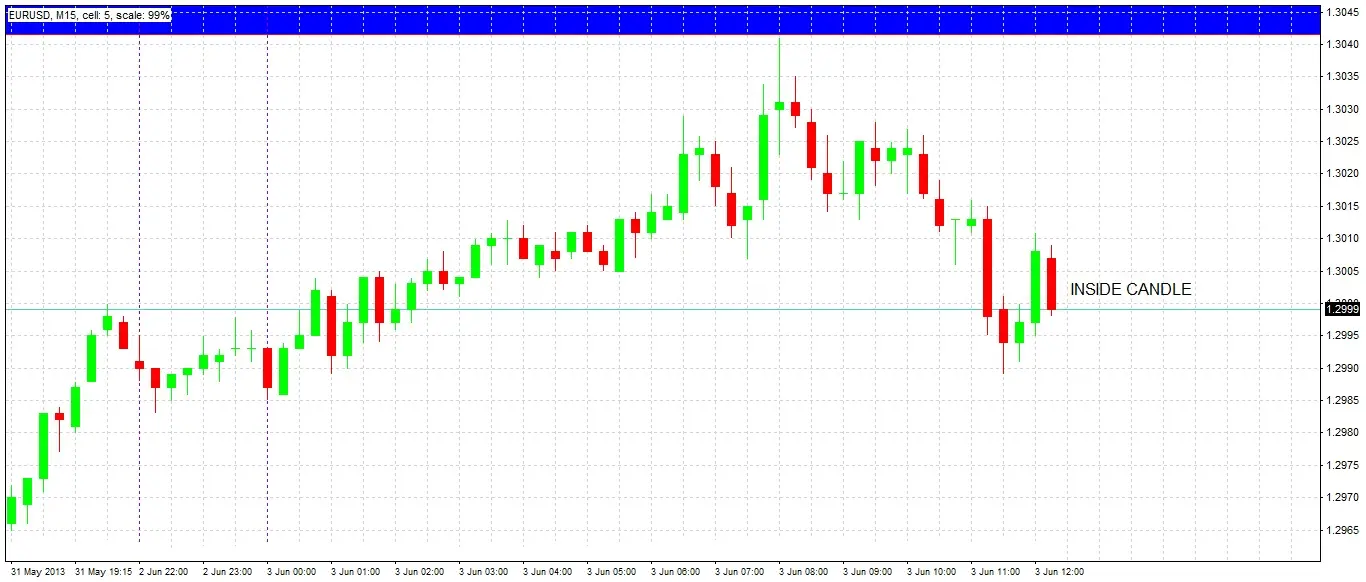

The very next candle is a bearish inside candle. We will enter if the price breaks below it by 1 pip during the next candle, with our stop above the high of the candle.

Entry

Within a few minutes, the low of the candle is broken by 1 pip, and our short trade is triggered. We continue to monitor the trade.

Trade Management 1

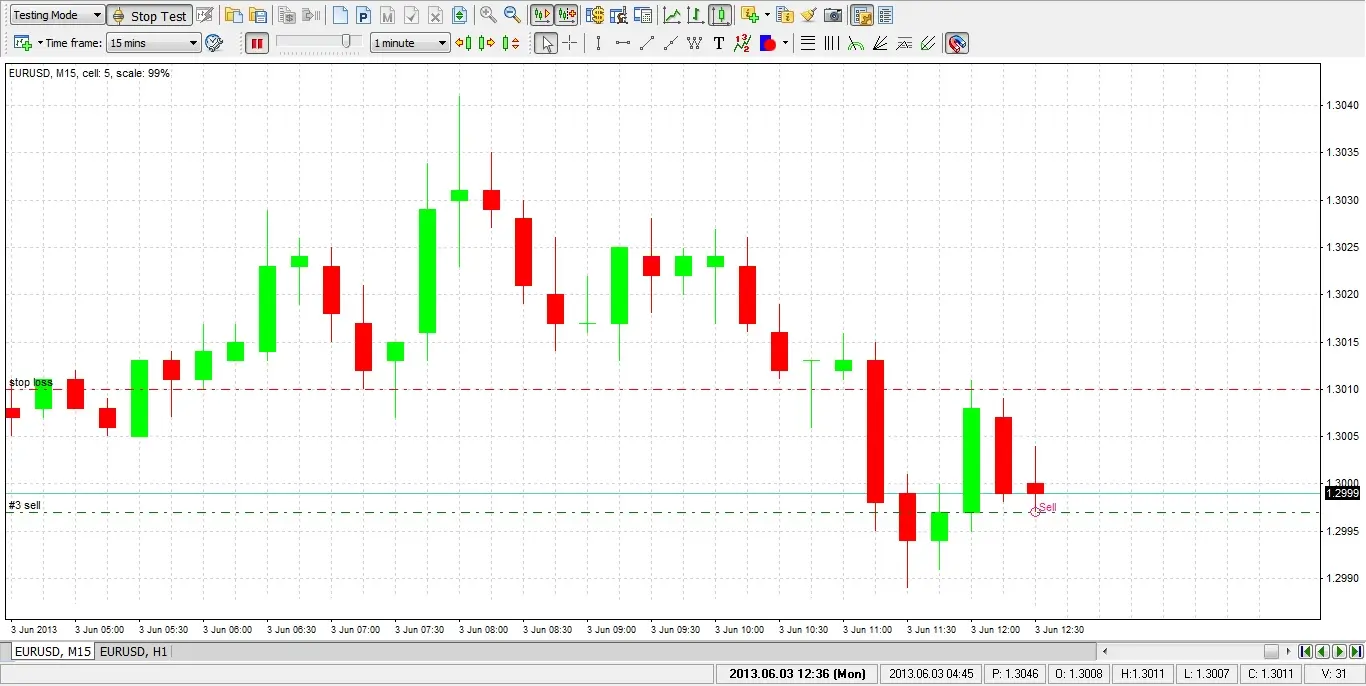

After about 45 minutes, it looks like our trade is progressing well. There was a bullish candle on the 15 minute chart, but it was followed by a bearish reversal bar. We also had a bearish break of an inside candle on the 1 hour chart. These were all good bearish signs. We continue to monitor our trade.

Trade Management 2

Another half hour passes, and both the charts are still printing nicely bearish candles. The price is currently close to the 200 EMA in the 1 hour chart. Our calendar reminds us that in 15 minutes time, there a is high-impact US economic news release concerning manufacturing data. How should we handle this? We need to stop and think.

Stop & Think

If the data that is released is significantly different to what the market is expecting, all USD pairs are likely to make sharp moves. We do not know whether this will work in our favour. Our trade is currently in profit by more than our risk, totalling +29 pips for a risk of 13 pips (+2.23 units of risk). We need to consider our options for managing the upcoming news announcement.

Option 1: Exit Immediately

Our trade is in profit by +2.23 units of risk. If we exit the trade now, we achieve a reward to risk ratio of over 2:1.

Option 2: Move Stop Loss to Break Even

We could move our stop loss to break even, ensuring that we are protected from a sudden large move against our trade. Bear in mind that, without using expensive guaranteed stops offered by some brokers, it is possible to suffer slippage in a very fast move, and make some kind of a loss. Normally, this should ensure we will exit with some profit, or at worst, no loss.

Option 3: Take Partial Profit

We can take most of the position as profit now, ensuring that whatever happens next, the trade as a whole will be profitable, even if we lose on the remaining portion of the trade.

Option 4: Take Partial Profit & Move Stop Loss to Break Even

This is the same as the previous option, but we are almost guaranteed to be even more profitable even if the price moves strongly against us.

Exit Decision

We decide to take Option 4, as we are sitting on the 200 EMA on the 1 hour chart which often acts as S/R, and as we are concerned that the upcoming news could move the price against us strongly. We exit 75% of our position at a profit of 29 pips, so we have 75% of 2.23 risk units = 1.67 risk units profit. As the news might move the price significantly further in our favour, we are prepared to see what the impact is, and are ready to have our finger on the exit button at 14:00 when the news is announced.

News Release

The data is released, showing that US manufacturing has contracted for the first time in 6 months. We can expect this information to cause the USD to fall, moving the price against our trade.

Conclusion

Within three minutes of the news announcement, the price rises back to 1.2997 and hits our stop, effecting our final exit from this trade. We had time to exit earlier at a better price, but as the price only moved 20 or so pips during the first minute after the announcement, we thought there was a chance our trade might survive. We ended up with a profitable trade overall due to our earlier partial exit, securing a reward of 1.67 units of risk.