EUR/JPY Trade Example 2

Multiple Time Frame Momentum Strategy Simulations: EUR/JPY Trade Example 2

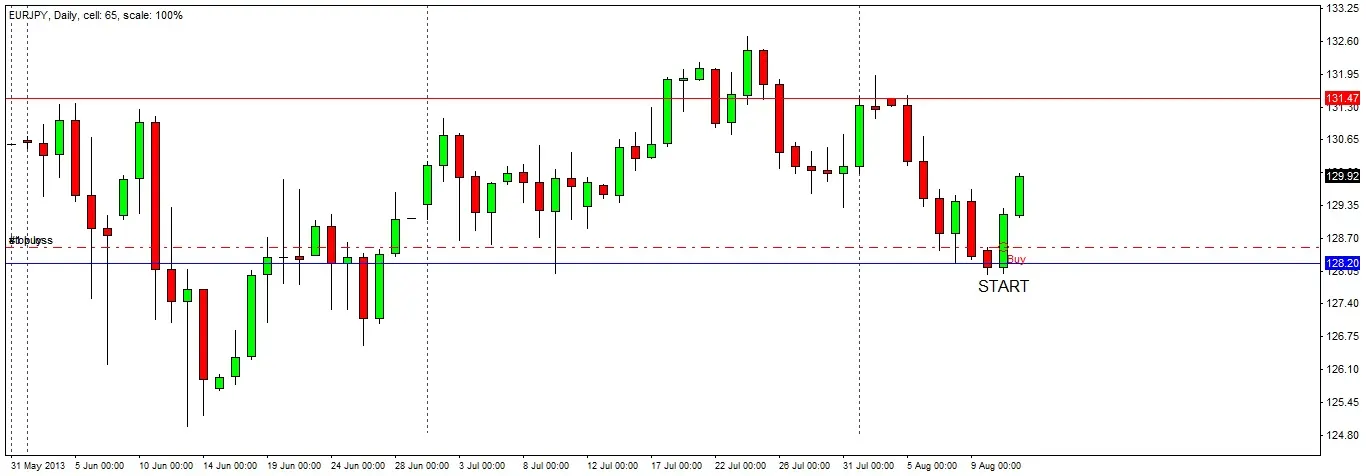

Based on actual trading data from August 08, 2013. Using the MTFM strategy on a major JPY cross, we use naked chart analysis to identify a strong S/R zone, and consider dropping down to a lower time frame to try to find a low-risk entry. The MTFM and Signal Candles, and position of support and resistance are considered before seeking an entry during the New York session.

EUR/JPY Trade Example 2

Subjects Covered:

- Multiple Time Frame Momentum Strategy

- Multiple Time Frame Coordination

- Signal Candles

- Position of Support/Resistance

- Highs and Lows

Signal 1

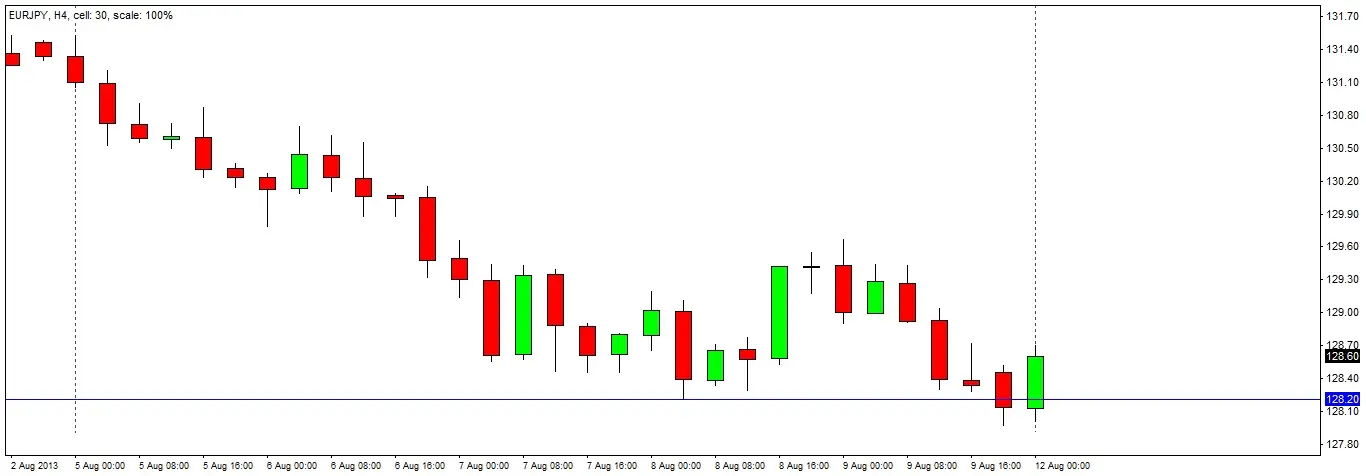

Before midnight on 12 August 2013, the price of this cross falls to hit the previous month’s low of 128.20, and the round number of 128.00.

The following H4 candle bounces upwards strongly off these levels. The candle’s close engulfs not only the open of the previous candle but also its high.

These are all technical signs that we may now be well positioned for a long entry. we coould enter at the break of the high of the H4 candle that has just closed, but we decide to drop down to the much shorter time frame of M15 to attempt to find a better entry.

Entry

After waiting all day, we finally get a strong bullish engulfing bar on the M15 time frame. There are several things that should make us optimistic about this trade:

1. We have already broken the high of the original bullish engulfing H4 candle.

2, The M15 bullish engulfing candle is very strong, closing right on its high and engulfing the real bodies of the previous 7 M15 candles.

We enter 1 pip above the high of the M15 candle at 128.49, placing our stop 1 below the low of the candle at 128.36, for a total risk of 13 pips.

Exit Targets

Now we have entered the trade, we need an initial exit target. Moving up to the daily chart to look for major support and resistance levels, we can see that the level at around 129.48 has recently acted as resistance last week, as well as being close to the low of 2 weeks ago.

We decide we will take half of our position as profit at this level and move the stop to break even, then wait and see how the price responds. If we reach our target, we will make a profit of approximately 4 units of risk, whatever happens next.

Exit 1

Later that same night, our first profit target of 129.48 is hit. We exit half our position and move our stop to breakeven. We have a guaranteed profit on this trade already of 3.80 units of risk.

At the London Open the next morning, we see that the price has risen quite easily through the level, making a succession of higher lows and higher highs. We can be more amitious with the profit target for our next exit.

Target 2

The next obvious target to take profit, considering the strength of the move up, is the previous week’s opening price of 131.47.

We decide to exit the remainder of our position here, which would give us a total profit on the trade of approimately 13 units of risk, which would be an excellent reward.

This was also an area of strong resistance over several months in 2009, so it may be likely that price will end its move here, or pause significantly before going higher.

Final Exit

We have to wait almost 10 days to reach our final target and sit through some pullbacks on the way, but we do hit the target and exit for a final reward of an extra 11.23 units of risk. Our total profit on the trade overall was 15.03 units of risk.

Note how it is psychologically easier to await a profit target for several days when significant profit has already been taken and the stop has been moved to break even.

Japan Shares Fall Strengthening JPY

Worse than expected Japanese GDP data leads to a strong fall in the value of Japanese shares. Paradoxically, a liquidation of a country’s share market can cause a strengthening of that country’s currency, as the shares are exchanged for currency. The JPY falls strongly to a significant bottom.