USD/JPY Trade

Intraday Price Action Strategy Simulations: USD/JPY Trade

Based on actual trading data from Dec 15, 2013. Using the Intraday Price Action Strategy on a major currency pair, we enter a short-term trade on an intraday basis. The Price Action Strategy signal, position of support and resistance, trend lines, and profit targets are considered before entry. The trade is given a wide ultimate profit target with two partial exits, but is only open for less than 24 hours.

USD/JPY Trade

Subjects Covered:

- Intraday Trading

- Signal Candles

- Position of Support/Resistance

- Quality of Support/Resistance

- Trend Line

- Trade Management

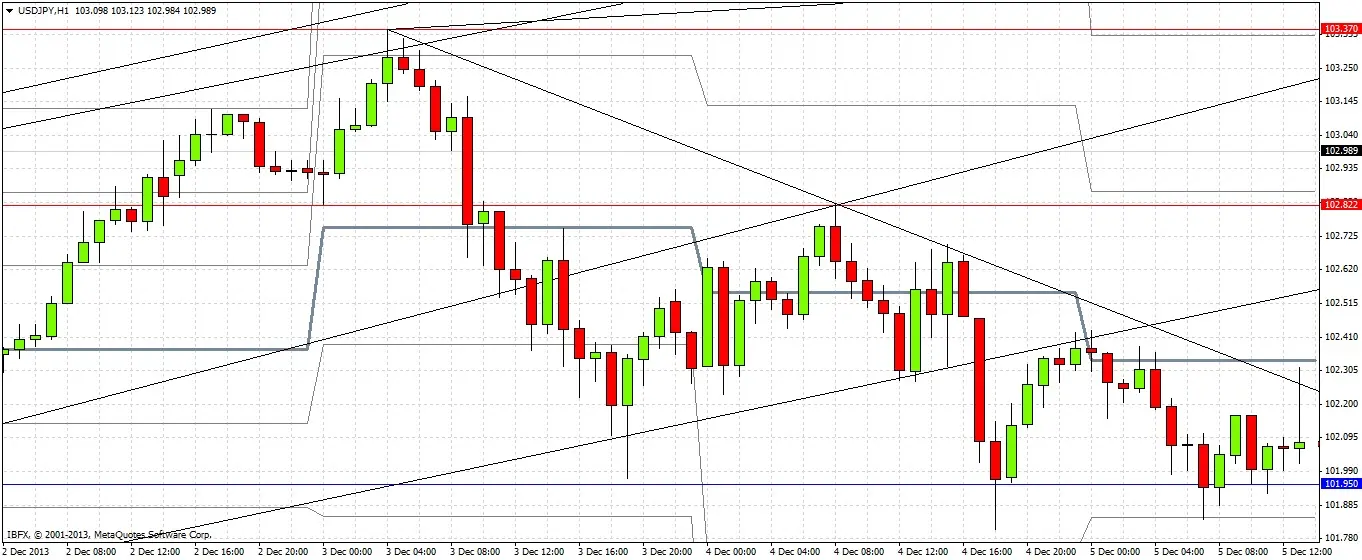

Daily Signal

Analysis at DailyForex.com identifies an opportunity for intraday traders to look for a short USD/JPY trade over the next 24 hours.

The primary justification is the identification of a bearish trend line. The trade is to be taken from a price action rejection of the bearish trend line, provided that a bullish trend line below is not hit by the price first.

As the price is within a rising channel, the profit targets are quite conservative. It is recommended to take risk off as early as 101.95.

U.S. Economic Data: Above Expectations

Two items of headline U.S. economic data are released: Preliminary GDP and Unemployment Claims. The news is USD-positive.

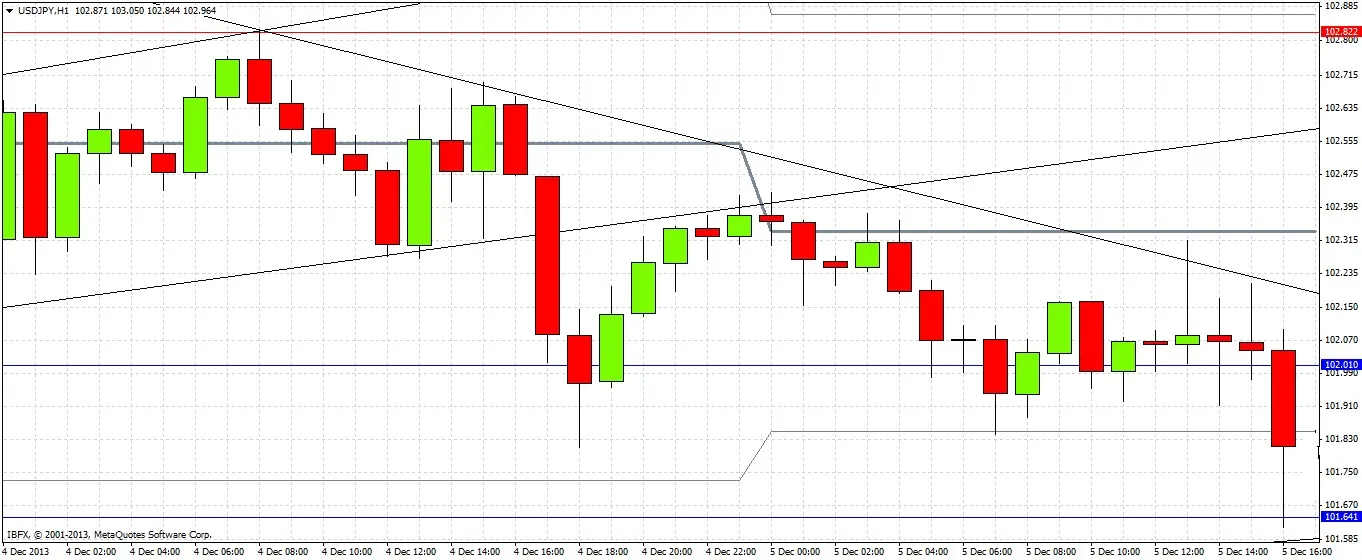

Signal Candle & Trade Decision

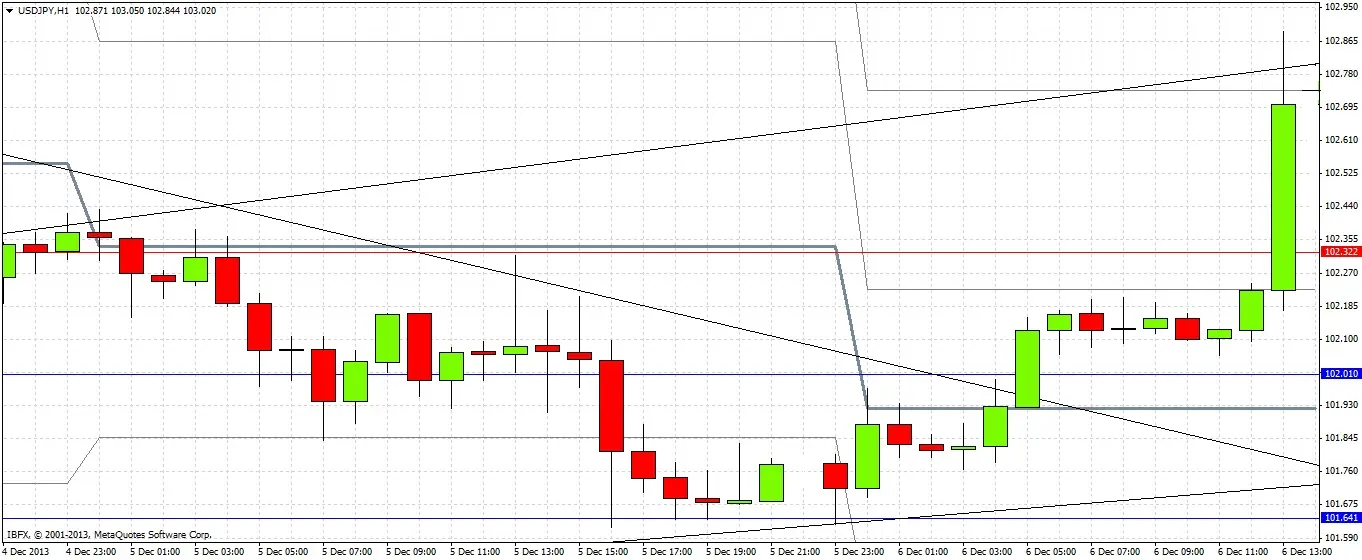

The news is positive for the USD, and in the few minutes following the news releases, the price of USD/JPY rises sharply to touch and surpass the bearish trend line by a few pips. However, a few minutes later, in spite of the news the price falls sharply from the trend line. It is a bearish sign when the price acts bearishly in the face of bullish news. By 2pm, the candle closes to form a bearish pin bar. We decide to enter the trade if the price breaks the low of this pin bar during the next hour, in line with the morning’s daily signal.

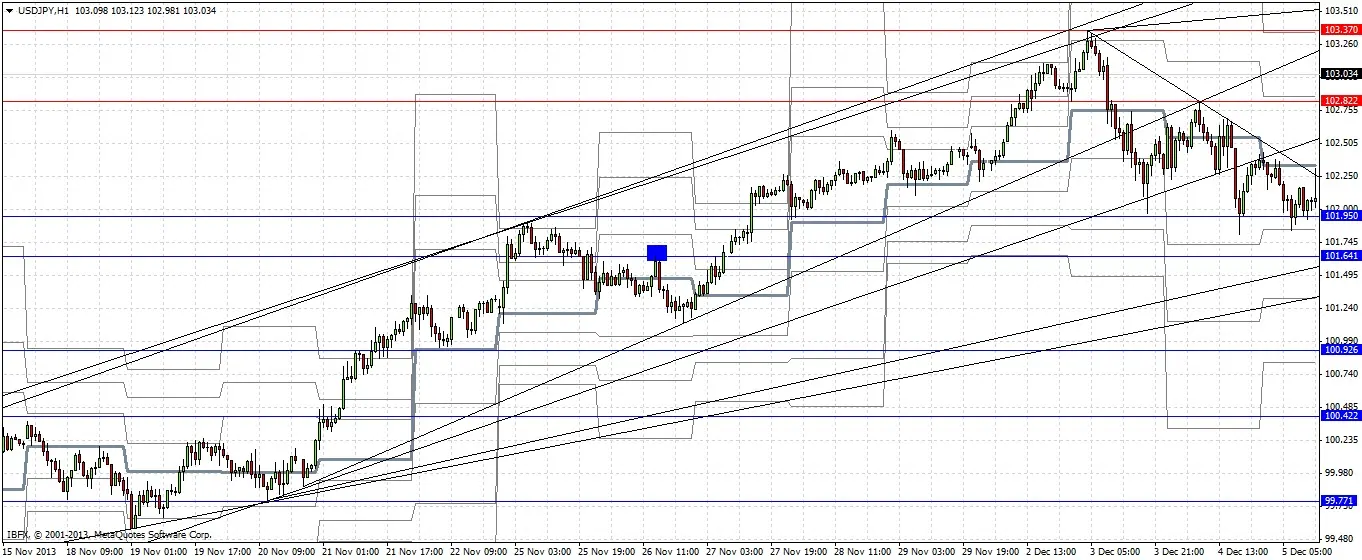

Identifying Profit Target 1

The first profit target of 101.65 is identified by a technical analysis of the chart to see where the last obvious resistance was given below the trade entry point.

We can see that on 26 November, the price powered up to make on obvious swing high at 101.64 before falling sharply. A level just slightly above this is an obvious place to suspect that the price might turn, as previous resistance could turn into support.

Entry

The entry level of 102.01 is triggered only 10 minutes after the close of the signal pin bar. The stop loss is placed 1 pip above the high of the pin bar at 102.32.

Exit 1

Only 3 hours after entry, our initial profit target of 101.64 is hit. we take 75% of the position as profit and move the stop loss to break even. We have gained 0.87 units of risk and may gain more. In the worst case scenario, we will end the trade with a total profit of 0.62 units of risk.

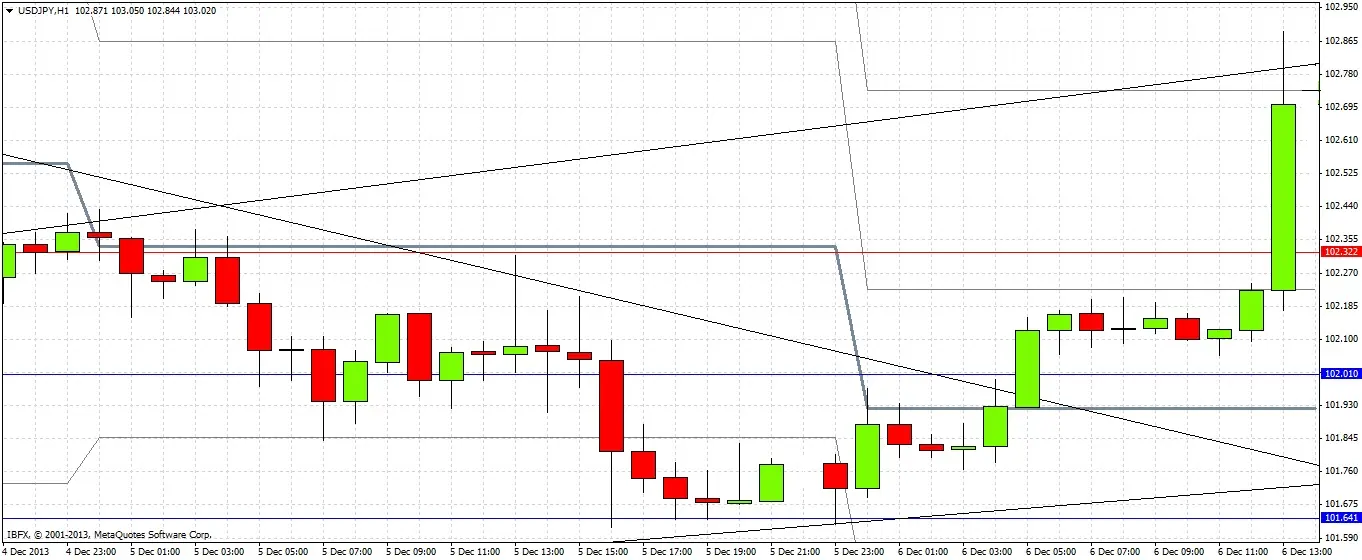

U.S. Economic Data: Non-Farm Payrolls

The trade survives for almost 24 hours, but looks to be going in the wrong direction. However we stick to the stop loss as the biggest USD economic data in the monthly calendar is about to be released, and if the news is bad we can expect it to push our trade strongly in the direction we want it to go.

The news is released and the data is very positive for the USD. We are stopped out of the trade almost immediately.

Final Exit

We are stopped out at 102.32 and the trade is over. We made a total profit of 0.62 units of risk, as we had earlier made 0.87 units as profit, but lost the remaining 0.25 units of the position when we were stopped out.

Conclusion

This trade shows the importance of paying attention to the release of major economic data and coordinating entries and exits with these events.

It also shows the importance of picking likely turning points skilfully for initial take profit or move stop to break even levels, especially where the trade is against the longer-term trend, as it was here.

Stop & Think

It is problematic that the entry is so close to the support level that was identified at 101.95. We decide instead to take 75% partial profit and all the risk off the trade at the next possible support level, which is 101.65, because within a the larger uptrend a conservative profit target on a short trade makes sense. Our stop loss is 1 pip above the high of the pin bar signal candle