USD/JPY Trade

Bollinger Bands Strategy Simulations: USD/JPY Trade

Based on actual trading data from July 29, 2014. Using the DBBs strategy on a major currency pair, we monitor the daily time frame to select a secure entry. The DBB signals, strength of the trend, and position of support and resistance are considered before entering at a time of day that is appropriate to this pair. The trade proceeds very smoothly, so the question of how to add to a winning position is examined.

USD/JPY Trade

Subjects Covered:

- Bollinger Band Momentum

- Signal Candles

- Position of Support/Resistance

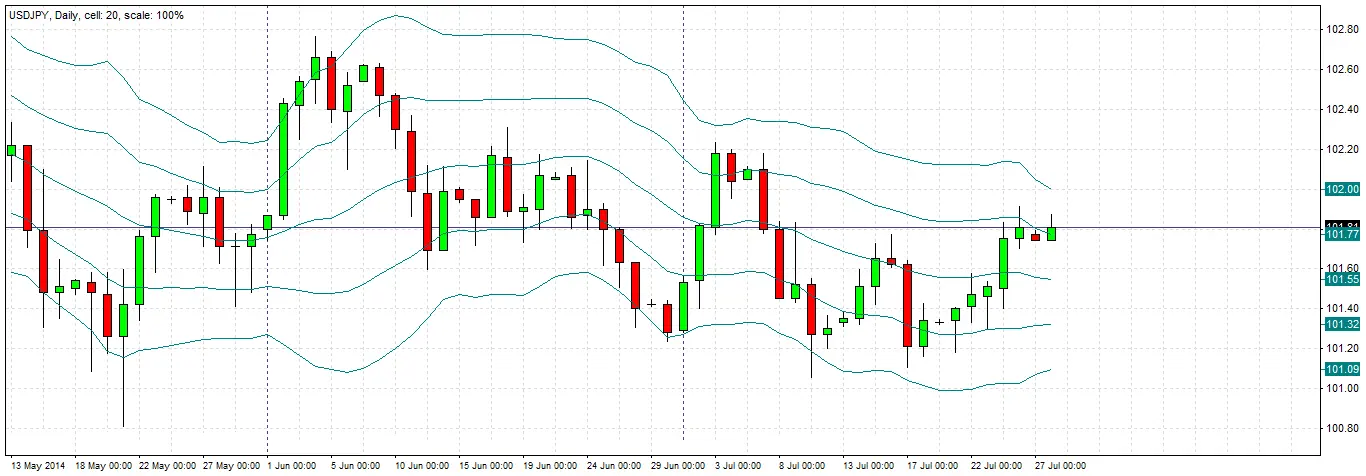

Signal 1

DBBs applied to the daily chart shows a change of status, with a first candle closing in the buy zone. This is a signal to look and see whether there are any other indications also supporting opening a long trade. The BBs are flat, and we are close to a few recent swing highs. Therefore it is best to wait and watch for the time being.

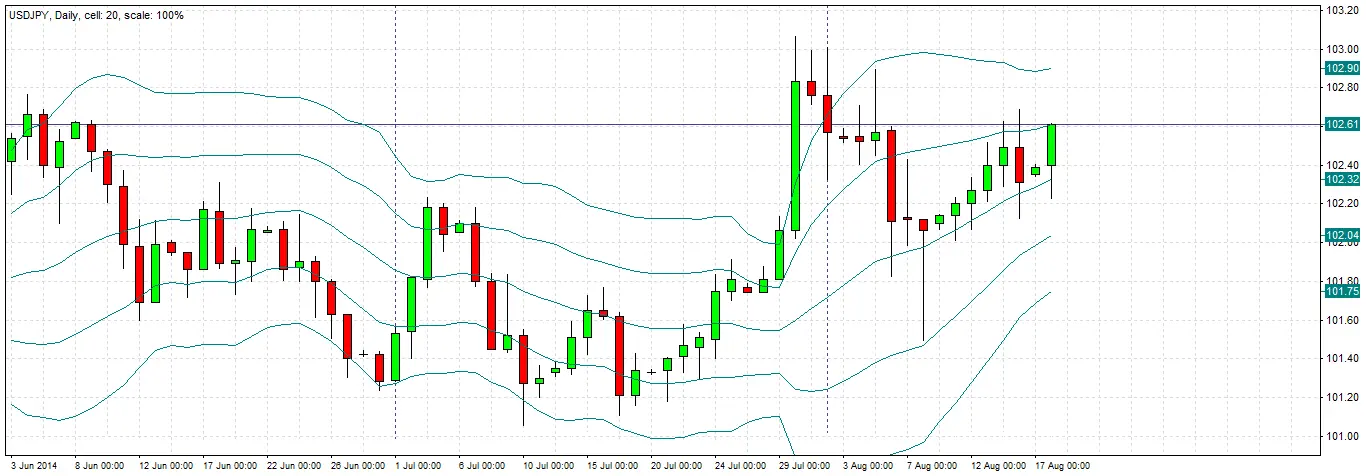

Trade Decision

The price shot up past all the Bollinger Bands the very next day, but fell back into the Neutral Zone pretty quickly. However the price did not fall below the central are within the Neutral Zone, and the Bands began to angle upwards. On 8th August, a bullish pin bar was formed, opening and closing just above the central line of the Bands on the 20 EMA: a bullish sign. The price then rose slowly over the next few days, and has finally closed in the Buy Zone.

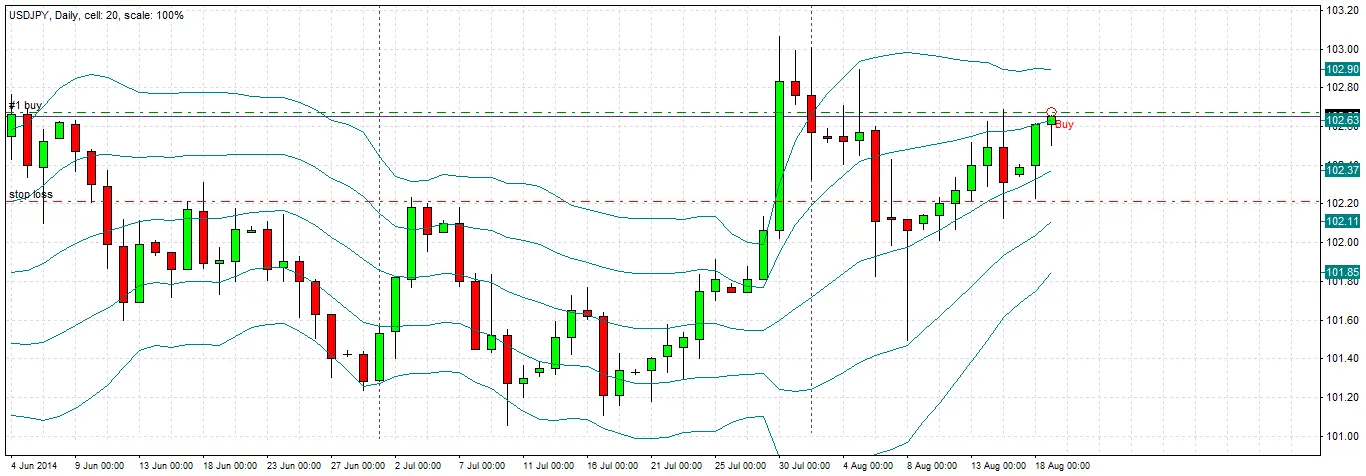

We decide to go long if the high of today’s daily candle is broken tomorrow. We will place the stop loss just below today’s low. It is a relatively small daily candle, which will improve our reward to risk ratio if the trade is a winner.

Trade Entry

Today the price rose sharply, triggering our entry. An advantage of the DBBs trading strategy is that you wait for the price to pull back into the neutral zone for a few days before exiting, so you have an automatic signal. We will wait for such a pull back to happen before exiting.